Commission draws provide income stability for sales reps.

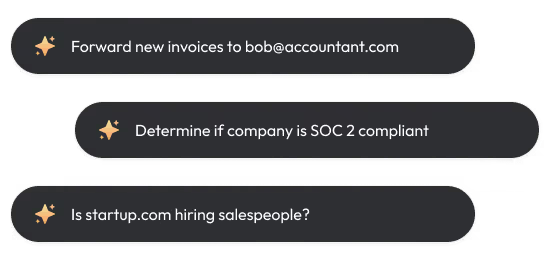

By the way, we're Bardeen, we build a free AI Agent for doing repetitive tasks.

Since you're learning about sales, you might love Bardeen's AI for sales tasks. It automates prospecting, lead generation, and more, letting you focus on closing deals.

Understanding sales commission draws is crucial for both sales reps and managers. Around 58% of sales reps rely on commissions as a significant portion of their income. Commission draws provide income stability, especially during ramp-up periods or economic uncertainty. However, they can also create pressure to perform and accrue debt if not managed properly.

In this comprehensive guide, we'll dive into the nitty-gritty of commission draws. What exactly are they, and how do they work? What are the pros and cons for reps and companies? How can you implement them effectively to motivate your team without breaking the bank?

By the end, you'll be a commission draw pro, ready to use this tool to boost your team's success. Let's get started!

What is a Sales Commission Draw and How Does it Benefit Sales Reps?

A sales commission draw is a type of guaranteed pay that sales representatives receive with each paycheck, functioning as an advance on their future commissions. This provides income stability and consistency for reps, especially during ramp up periods or times of economic uncertainty.

The key purposes of a commission draw are:

1. Providing Income Stability During Ramp Up

When sales reps are newly hired or taking on new accounts, a commission draw ensures they have a reliable income as they build up their sales pipeline and start closing deals. For example, a software company may offer a $2,000 monthly draw for the first 6 months as a new sales hire gets up to speed.

2. Maintaining Earnings Through Slow Periods

Sales can fluctuate seasonally or be impacted by external factors like economic downturns. A draw against commission helps smooth out rep earnings during these slow times. A company may implement a temporary $500 per paycheck draw during an industry-wide sales slump to keep reps motivated and prevent turnover.

3. Differing From Salary or Bonuses

While a draw provides guaranteed pay, it differs from a salary because it is an advance on the rep's expected commissions, not extra pay on top of commissions. It also differs from a bonus, which is typically a one-time payout for hitting certain goals, not an ongoing minimum pay. The draw interacts with commissions, being deducted from what the rep earns in a given period.

In summary, a sales commission draw provides reps with a reliable income stream, helping maintain stability and motivation through ramp up periods and sales fluctuations. In the next section, we'll cover the different types of commission draws and when to use them based on buying signals.

Understanding the Two Main Types of Sales Commission Draws

Sales commission draws come in two main varieties - recoverable and non-recoverable draws. The type of draw used depends on the situation, such as providing income stability for new hires or supporting reps during economic disruptions. Let's take a closer look at how each type of draw against commission functions and when to use them.

1. Recoverable Draws: Advances Paid Back from Future Commissions

A recoverable draw is an advance on future commissions that the sales rep must eventually earn back. If a rep receives a $2,000 draw in one pay period but only earns $1,500 in commissions, the $500 difference carries over to the next period. The rep's future commission checks will be reduced until the draw is fully repaid.

Recoverable draws are commonly used for new sales hires. The guaranteed pay helps them ramp up and build a pipeline. As their deals start closing and commissions increase, the draw amount may be reduced until they are self-sufficient on commission alone.

2. Non-Recoverable Draws: Guaranteed Pay Not Requiring Repayment

In contrast, a non-recoverable draw functions more like a stipend or bonus. The rep receives the guaranteed amount even if they don't earn enough commission to cover it that period. This type of draw is typically used as a short-term tactic to support reps during extenuating circumstances.

For example, during an economic downturn or industry disruption, a company may implement non-recoverable draws to maintain sales force motivation and retention. Since reps can't control external factors dampening sales, the guaranteed pay provides stability until conditions improve.

3. How Draws Interact with Commissions Each Pay Period

To see a draw against commission in action, consider a rep with a $1,000 bi-weekly recoverable draw. In the first pay period, they earn $800 in commissions, so the additional $200 draw carries over. In period two, commissions are $1,200, so they receive the extra $200 and the draw balance resets to $0.

Had this been a non-recoverable draw, the rep would keep the extra $200 in the first period. The second period's $1,200 earnings would be added on top of the draw amount for total pay of $2,200.

The key difference is that recoverable draws act as temporary income smoothing, while non-recoverable draws provide bonus pay. Next, we'll weigh the benefits and drawbacks of using commission draws in your sales compensation plan.

Use Bardeen to easily automate your sales prospecting tasks and save time on repetitive work. It lets you stay focused on closing deals without getting bogged down.

Weighing the Pros and Cons of Commission Draws for Your Sales Team

Commission draws offer a way to provide income stability and motivate sales reps, but they also come with potential drawbacks. Sales commission draws act as an advance on future commissions, giving reps a reliable paycheck even during slow periods or long sales cycles. However, recoverable draws must eventually be repaid, which can lead to debt or reduced earnings down the line. Let's examine the key advantages and disadvantages of using draws in your sales compensation plan.

1. Guaranteed Income Keeps Reps Motivated and Focused

One of the primary benefits of commission draws is providing sales reps with a steady, predictable income stream. This financial stability helps reduce stress and allows reps to focus on selling rather than worrying about making ends meet. For example, a software company might offer new sales hires a $2,500 monthly draw during their first 6 months as they build a pipeline and learn the ropes.

Draws are especially helpful for reps working long sales cycles, where commissions may only be paid quarterly or annually. The regular draw payments smooth out cash flow and keep reps engaged throughout the process. This consistency aids in talent attraction and retention.

2. Pressure to Perform Can Lead to Stress and Turnover

On the flip side, commission draws can create significant pressure for sales reps to hit their quotas. With a recoverable draw, any shortfall must be repaid from future earnings. This accrued "debt" to the company can be a major source of stress, especially for reps who fall behind.

If a rep has a few bad months, they may find themselves in a hole that feels impossible to dig out of. This scenario often leads to burnout, disengagement, and turnover - saddling the company with debt from unrecovered draws. Employers must weigh the motivational benefits against these risks.

3. Balancing Incentives and Security Depends on the Situation

Ultimately, whether the pros of commission draws outweigh the cons depends on your specific company, sales cycle, and team. Draws are best used selectively - either for new hires as they ramp up or during temporary slow periods - not as a permanent pay structure.

The draw amount should be carefully set to provide a safety net without eliminating the drive to sell beyond it. And recoverable draws must be tracked and managed closely to identify issues early. When used judiciously, draws against commission can be a valuable tool for keeping sales reps motivated and on track.

The key is striking the right balance between incentives and security. Next up, we'll share best practices for implementing commission draws effectively.

Setting Up Sales Commission Draws for Success

Implementing commission draws effectively requires careful planning and clear communication. Setting the right draw amount is crucial - it needs to provide income stability for reps while still being financially viable for the company. Best practices include starting new hires on a draw during ramp-up, then tapering it off as they build pipeline. Draws should be used selectively, not as a permanent pay structure. Transparency around draw policies prevents confusion and keeps teams motivated.

1. Finding the Goldilocks Draw Amount

The key to a successful commission draw is setting the amount just right. It can't be so low that reps struggle to make ends meet, but it also can't break the company budget. For example, a software company might offer new sales hires a $3,000 monthly draw for their first 3 months. This provides a reliable income as they prospect and learn the ropes.

Use sales prospecting automation to enhance your team's efficiency and focus on closing deals faster.

Finance should work with sales leaders to model out different draw scenarios and find the sweet spot. The amount should be reevaluated periodically as base pay and average deal sizes change. Draws that are too cushy can actually demotivate reps, so striking the right balance is key.

2. Phasing Out Draws as Reps Ramp Up

Commission draws are most impactful for new hires and reps building pipeline after a territory change. But they shouldn't be relied on indefinitely. Best practice is to start reps on a draw, then phase it out over time as they gain traction.

Let's say an industrial equipment company offers a $4,000 monthly draw for an entry-level rep's first 6 months. After that, the draw might decrease by $1,000 each quarter until it reaches zero at the 12-month mark. This gradual tapering incentivizes reps to get up to speed quickly while providing a safety net.

3. Transparency and Documentation Prevent Drama

Rolling out a new commission draw structure can easily cause confusion and resentment if not handled properly. Avoiding drama hinges on clear communication from leadership about the reasoning behind draws and exactly how they work.

Policies should be documented in the sales compensation plan, outlining the draw amount, time frame, and any payback provisions. Managers need to meet with reps individually to walk through the details and address concerns. Ongoing reminders about draw status keep everyone on the same page.

When a rep's draw period is ending, give ample notice and celebrate their progress. A little proactive communication goes a long way in keeping the team bought in.

Commission draws can be a powerful motivator when used strategically. The formula for success is finding the right balance, phasing out gradually, and staying transparent. Thanks for sticking with us through this deep dive on draws - you're well on your way to becoming a commission draw pro! Just don't let all that newfound knowledge go to your head.

Conclusions

Understanding sales commission draws is crucial for designing effective compensation plans that motivate reps. Automating sales processes with AI can further enhance your team's efficiency.

In this guide, you discovered:

- How commission draws provide income stability and differ from salary or bonuses

- The two main types of draws - recoverable and non-recoverable - and when to use each

- Key benefits and potential drawbacks of draws for both reps and companies

- Best practices for implementing draws, like setting reasonable amounts and communicating policies clearly

Don't let your lack of commission draw expertise hold back your sales team - the competition will leave you in the dust! Utilize lead enrichment techniques to stay ahead.

.svg)

.svg)

.svg)