A sales allowance is a price reduction for product issues.

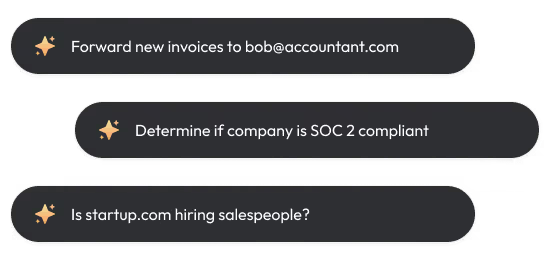

By the way, we're Bardeen, we build a free AI Agent for doing repetitive tasks.

If you're handling sales allowances, you might find Bardeen's AI SDR tools useful. They automate sales tasks, saving you time and improving efficiency.

When it comes to managing a business's finances, understanding sales allowances is crucial. Sales allowances are a common practice that can significantly impact a company's bottom line, yet many entrepreneurs and managers struggle to grasp their intricacies.

In this comprehensive guide, we'll dive into the world of sales allowances, explaining what they are, how they differ from discounts and returns, and the best practices for implementing them effectively. By the end, you'll have a solid understanding of this essential concept and be equipped to make informed decisions for your business.

So, let's get started on this journey to mastering sales allowances!

What You Need to Know About Sales Allowances

A sales allowance is a reduction in price offered by a seller to a buyer due to an issue with the product or service, such as a quality problem, incorrect pricing, or incomplete shipment. It's an alternative to the buyer returning the item for a full refund. Let's dive into the basics of sales allowances and how they work in practice.

1. Sales Allowances vs. Sales Discounts and Returns

A sales allowance differs from a sales discount, which is a reduction in price offered upfront to incentivize a purchase. It also differs from a sales return, where the buyer sends the product back for a full refund. With a sales allowance, the buyer keeps the item but receives a partial refund or credit.

For example, if a customer receives a defective product but still wants to keep it, the seller may offer a sales allowance of 20% off the original price. The customer gets to keep the item at a reduced cost, and the seller avoids the hassle and expense of processing a return.

2. Benefits of Offering Sales Allowances

Offering sales allowances can benefit both the seller and the buyer. For the seller, it can help maintain good customer relationships by showing a willingness to make things right when issues arise. It can also be less costly and time-consuming than processing a full return.

For the buyer, a sales allowance provides a way to keep a product they want or need, even if it's not perfect, while still receiving some compensation for the issue. It can be a win-win solution that leaves both parties satisfied.

3. Impact on Revenue and Financial Statements

When a company offers a sales allowance, it reduces the amount of revenue recognized from that sale. The allowance is recorded as a debit to the "Sales Returns and Allowances" account and a credit to the "Accounts Receivable" account (for customers with an account) or the "Cash" account (for cash sales).

At the end of the reporting period, the total amount of sales allowances is deducted from gross revenue to arrive at net revenue. This ensures that the company's financial statements accurately reflect the true amount of revenue earned.

Sales allowances are a useful tool for businesses to handle issues with products or services while maintaining good customer relationships. By understanding how they work and their impact on revenue, companies can effectively manage sales allowances as part of their overall financial strategy. To learn more about sales intelligence, you can enhance your sales strategies and decision-making processes.

In the next section, we'll explore the process of calculating and recording sales allowances in accounting, including examples and best practices.

Calculating and Recording Sales Allowances in Accounting

Calculating and recording sales allowances is a crucial part of accounting for any business that offers them. The amount of the allowance must be accurately determined and properly documented in the company's financial records. This section will guide you through the process step-by-step, with examples to illustrate the impact on financial statements and best practices for tracking allowances over time.

1. Determining the Sales Allowance Amount

The first step in accounting for a sales allowance is to calculate the amount to be credited to the customer. This is typically done by multiplying the original sale price by the agreed-upon allowance percentage.

For example, if a customer purchases a product for $100 and is granted a 10% allowance due to a defect, the sales allowance would be $10 ($100 x 10%). The customer would then pay $90 for the item, and the company would record $90 in revenue instead of the original $100.

2. Recording Sales Allowances in Accounting Ledgers

Once the sales allowance amount is determined, it must be recorded in the company's accounting ledgers. This involves debiting the Sales Returns and Allowances account and crediting the Accounts Receivable account (for credit sales) or Cash account (for cash sales).

Continuing with the previous example, the journal entry would be:

- Debit Sales Returns and Allowances: $10

- Credit Accounts Receivable/Cash: $10

This entry reduces the total amount owed by the customer and decreases the company's revenue by the amount of the allowance.

3. Impact on Financial Statements

Sales allowances impact a company's financial statements by reducing the total revenue reported. On the income statement, the Sales Returns and Allowances account is subtracted from Gross Sales to arrive at Net Sales.

For instance, if a company has $100,000 in gross sales and $5,000 in sales allowances for a given period, the net sales reported on the income statement would be $95,000 ($100,000 - $5,000). This reduction in revenue also decreases the company's gross profit and net income.

4. Best Practices for Tracking Sales Allowances

To effectively manage sales allowances, companies should implement a system for tracking and monitoring them over time. This includes maintaining detailed records of each allowance granted, including the customer, product, amount, and reason for the allowance.

Regularly reviewing sales allowance data can help identify trends or issues that may need to be addressed, such as recurring product defects or customer service problems. By staying on top of sales allowances, companies can make informed decisions and take proactive steps to minimize their financial impact.

Proper calculation and recording of sales allowances are essential for accurate financial reporting and effective management of these price reductions. By following these guidelines and best practices, businesses can ensure that their accounting for sales allowances is thorough and compliant.

Ready to dive deeper? The next section explores the ins and outs of implementing effective sales allowance policies, from development to communication and beyond.

Save time on routine tasks by using Bardeen's automation playbooks for data collection and lead qualification.

Implementing Sales Allowance Policies Effectively

Developing and implementing a sales allowance policy requires careful consideration of various factors to ensure its effectiveness. Clear communication of the policy terms to customers and proper training of sales teams are essential for smooth implementation. Strategies to minimize policy abuse are also crucial. This section will guide you through the key elements of creating and executing a successful sales allowance policy.

1. Factors to Consider When Developing a Policy

When crafting a sales allowance policy, several factors must be taken into account. First, the policy should align with the company's overall goals and objectives. It should also consider the specific needs and preferences of the target customer base.

Additionally, the financial impact of the policy on the company's revenue and profitability must be carefully assessed. This includes setting appropriate allowance percentages and determining which products or services are eligible for allowances.

2. Communicating Sales Allowance Terms Clearly

Clear communication of the sales allowance policy terms to customers is crucial for avoiding confusion and misunderstandings. The policy should be written in plain language and easily accessible to customers, such as on the company's website or in product documentation.

Key details to communicate include the specific circumstances under which allowances are granted, the process for requesting an allowance, and any deadlines or limitations. Providing examples of common situations where allowances apply can also be helpful.

3. Training Sales Teams to Handle Allowance Requests

Proper training of sales teams is essential for ensuring that allowance requests are handled consistently and in accordance with the policy. Sales representatives should be well-versed in the policy terms and able to explain them clearly to customers.

Training should cover how to assess the validity of allowance requests, how to process approved requests, and how to handle any disputes or escalations. Preparing for sales calls can also help in managing these interactions effectively.

4. Minimizing Abuse of Sales Allowance Policies

To prevent abuse of the sales allowance policy, it's important to have strategies in place for monitoring and controlling its use. This may include setting limits on the frequency or total amount of allowances that can be granted to a single customer.

Regularly reviewing allowance data can help identify any unusual patterns or potential abuse. Implementing an approval process for allowances over a certain threshold can also provide an additional layer of control.

A well-designed and effectively implemented sales allowance policy is a valuable tool for any business. By considering the key factors, communicating clearly with customers, training sales teams, and monitoring for abuse, companies can reap the benefits of increased customer satisfaction and loyalty.

Now that you've mastered the art of implementing a sales allowance policy, let's explore the pros and cons of offering these allowances in the first place.

Advantages and Disadvantages of Offering Sales Allowances

Offering sales allowances can be a strategic move for businesses looking to maintain customer satisfaction, move inventory, and foster loyalty. However, there are also potential drawbacks to consider. In this section, we'll explore the pros and cons of implementing a sales allowance policy and provide guidance on when it may be more advantageous than offering discounts or returns.

1. Improved Customer Satisfaction and Loyalty

One of the primary benefits of offering sales allowances is the positive impact on customer satisfaction. By providing compensation for defective or underperforming products, businesses demonstrate their commitment to making things right for their customers.

For example, if a customer purchases a smartphone that develops a screen issue within the first month, offering a sales allowance to cover the cost of repair can prevent frustration and maintain trust in the brand. This proactive approach to customer service can lead to increased loyalty and repeat business.

2. Moving Defective or Slow-Moving Inventory

Sales allowances can also be a useful tool for moving inventory that may otherwise be difficult to sell. If a product has minor defects or is approaching the end of its shelf life, offering a sales allowance can incentivize customers to purchase the item at a reduced price.

For instance, a clothing retailer might offer a sales allowance on a batch of shirts with minor stitching imperfections. By discounting the items, the retailer can clear out the inventory and minimize losses, while still providing value to budget-conscious customers.

3. Potential Drawbacks: Reduced Revenue and Abuse

While sales allowances offer benefits, they also come with potential drawbacks. One of the primary concerns is the impact on revenue. By offering discounts or credits, businesses are essentially reducing the amount of money they collect from each sale.

Additionally, there is a risk of customers abusing sales allowance policies. Some individuals may attempt to take advantage of the system by exaggerating product issues or making false claims to receive unwarranted discounts. Implementing clear guidelines and monitoring allowance patterns can help mitigate this risk.

4. When to Offer Allowances vs. Discounts or Returns

Deciding whether to offer a sales allowance, discount, or return depends on the specific situation and goals of the business. Sales allowances are typically best suited for scenarios where the product is still functional but may have minor defects or performance issues.

If the product is severely damaged or entirely non-functional, a full return or replacement may be more appropriate. Discounts, on the other hand, are often used as a promotional tool to encourage sales and are not necessarily tied to product quality issues.

By carefully considering the circumstances and weighing the pros and cons, businesses can determine the most effective approach to handling customer concerns and maintaining satisfaction.

Sales allowances can be a valuable addition to a business's customer service toolkit, but it's essential to weigh the benefits against the potential drawbacks. By finding the right balance and implementing clear policies, companies can leverage sales allowances to build customer loyalty and drive long-term success.

Thank you for sticking with us through this in-depth exploration of sales allowances! We hope you're now equipped with the knowledge to make informed decisions for your business. Remember, mastering the art of sales demos is just one piece of the puzzle – don't neglect the rest of your customer service strategy, or you might find yourself in a sticky situation!

Save time and increase impact by using automation tools for sales prospecting. Eliminate manual tasks and focus on growing your business.

Conclusions

Understanding sales allowances is crucial for businesses to effectively manage customer satisfaction, inventory, and financial performance. In this guide, you discovered:

- The basics of sales allowances, including their purpose, benefits, and how they differ from discounts and returns

- How to calculate and record sales allowances in accounting, and the impact on financial statements

- Best practices for implementing effective sales allowance policies and minimizing potential abuse

- The advantages and disadvantages of offering sales allowances, and when they may be more advantageous than alternatives

By mastering the concept of sales allowances, you'll be well-equipped to make informed decisions that benefit your customers and your bottom line. Don't let your lack of knowledge leave you with a pile of unsold inventory and unhappy customers! To further improve your sales strategies, explore automating sales prospecting with AI.

.svg)

.svg)

.svg)