DocuSign verifies identity using methods like ID checks and biometrics.

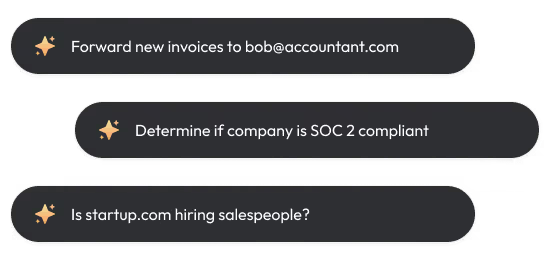

By the way, we're Bardeen, we build a free AI Agent for doing repetitive tasks.

If you're handling agreements, Bardeen's AI automation tools can help you save time and focus on important tasks.

In today's digital age, verifying signer identity is crucial for secure, legally binding agreements. DocuSign, a leader in electronic signature solutions, offers robust identity verification methods to protect your business. Did you know that 84% of businesses say certainty about identity would reduce their risk?

This comprehensive guide will walk you through DocuSign's identity verification process, from government-issued IDs to biometric checks. You'll also discover how DocuSign's automated AI-powered verification can save you time and streamline your workflow. Get ready to master identity verification and safeguard your agreements like a pro!

DocuSign's Identity Verification Methods

DocuSign offers a range of methods to verify signer identity, going beyond the standard practice of clicking an emailed link. These methods help protect important agreements while providing a seamless signing experience.

1. Government-Issued ID Verification

DocuSign's ID Verification process uses government-issued IDs to confirm signer identity. Signers upload a photo of their ID, such as a driver's license or passport. DocuSign then checks the authenticity of the ID.

Additionally, biometric checks like liveness detection are used. This involves the signer taking a video selfie, which is analyzed to ensure they are a real person. Face matching technology compares the selfie to the photo on the ID to verify they match.

2. Phone Authentication

With DocuSign's Phone Authentication, a one-time password (OTP) is sent to the signer via SMS or phone call. The signer must enter this OTP during the signing process to prove their identity.

This two-factor authentication method adds an extra layer of security. It helps confirm the signer has access to the phone number associated with their identity.

3. Knowledge-Based Authentication

DocuSign's Knowledge-Based Authentication asks signers personal questions to verify their identity. These questions are pulled from commercial databases and may relate to information like:

- Current and previous addresses

- Vehicle ownership history

- Credit history

The signer must correctly answer these questions within a set number of attempts to access the agreement.

In summary, DocuSign offers robust identity verification methods like government ID checks, phone authentication, and knowledge-based questions. These work together to confirm signer identities while maintaining a smooth digital signing experience.

Next, we'll explore when to use these identity verification methods in your DocuSign workflows. For more information on enhancing data accuracy, check out our guide on data enrichment.

When to Use Identity Verification in DocuSign

DocuSign's identity verification is crucial for high-value, high-risk agreements that require an extra level of security. Different industries and agreement types have specific requirements around verifying signer identities to prevent fraud and ensure legal enforceability.

1. High-Stakes Agreements

Identity verification is essential for agreements with significant financial or legal implications, such as:

- Loan and lease applications

- Insurance policies

- Real estate contracts

For example, a bank issuing a mortgage will require the borrower to complete identity verification to confirm they are who they claim to be. This helps prevent fraudulent loan applications and protects both the bank and legitimate borrowers.

Automate repetitive tasks and focus on high-stakes agreements by leveraging Bardeen's automation tools. Save time and ensure compliance with ease.

2. Industry-Specific Requirements

Certain industries have strict regulations around identity verification for agreements and transactions. These include:

- Financial services

- Healthcare

- Government

For instance, financial institutions must follow Know Your Customer (KYC) regulations, which mandate verifying customer identities before opening accounts or processing transactions. DocuSign's identity verification helps these companies meet their compliance obligations.

3. Compliance with KYC and AML Regulations

Beyond industry-specific requirements, many companies are subject to broader regulations around Know Your Customer (KYC) and Anti-Money Laundering (AML). These require businesses to verify customer identities and monitor for suspicious activity.

DocuSign's identity verification options, like government ID authentication and knowledge-based questions, give companies the tools to comply with KYC and AML regulations when executing agreements.

DocuSign's identity verification methods help companies secure high-stakes agreements, meet industry requirements, and comply with regulations. Next, learn how these identity checks benefit your business and agreements with our automation tools.

Benefits of DocuSign Identity Verification

DocuSign's identity verification methods provide multiple benefits to organizations looking to secure their agreements and transactions. By verifying signer identities, companies can prevent fraud, ensure legal enforceability, and deliver a seamless signing experience.

1. Fraud Prevention and Legal Enforceability

Identity verification is a critical tool in preventing fraudulent activity during the signing process. By confirming that signers are who they claim to be, DocuSign helps organizations mitigate the risk of unauthorized individuals entering into agreements.

Moreover, identity verification ensures that agreements signed through DocuSign are legally binding and enforceable. This is especially important for high-value or sensitive transactions, where the validity of the agreement may be scrutinized in court.

2. Seamless Integration with DocuSign Workflow

DocuSign's identity verification methods are designed to integrate smoothly into the existing signing workflow. Signers can complete the verification process directly within the DocuSign platform, without the need for separate applications or tools.

This seamless integration minimizes friction for signers and helps maintain a positive user experience. Organizations can configure the level of identity verification required based on their specific needs and risk tolerance.

3. Comprehensive Audit Trail and Security

When identity verification is used in conjunction with DocuSign's electronic signature platform, the details of the verification process are recorded in the audit trail and Certificate of Completion. This provides a comprehensive record of the signer's identity and the steps taken to verify it.

The audit trail serves as evidence of the agreement's validity and can be used to demonstrate compliance with regulatory requirements. Additionally, DocuSign's platform employs robust security measures to protect sensitive data collected during the identity verification process.

DocuSign's identity verification options deliver fraud prevention, legal enforceability, and a seamless user experience. Next, discover how identity verification relates to electronic and digital signatures under eIDAS regulations.

DocuSign Identity Verification and Electronic Signatures

DocuSign's identity verification methods play a crucial role in enabling different types of electronic signatures under the eIDAS regulation. By verifying signer identities, DocuSign helps organizations achieve higher levels of assurance and compliance for their electronic agreements.

Electronic signatures come in various forms, each with different levels of security and legal recognition. Simple Electronic Signatures (SES) are the most basic type, followed by Advanced Electronic Signatures (AES) and Qualified Electronic Signatures (QES).

1. Simple, Advanced, and Qualified E-Signatures

A Simple Electronic Signature (SES) is any electronic data attached to or logically associated with a document, used by the signer to indicate their acceptance or approval. This could include a typed name, a scanned signature image, or a click on an "I accept" button.

An Advanced Electronic Signature (AES) must meet specific requirements, such as being uniquely linked to the signer, capable of identifying the signer, and created using signature creation data under the signer's sole control. DocuSign's identity verification methods, like ID document verification and knowledge-based authentication, enable organizations to achieve AES.

A Qualified Electronic Signature (QES) is an AES backed by a qualified certificate issued by a trust service provider on the EU Trusted List. It has the equivalent legal effect of a handwritten signature across the EU. DocuSign's ID Verification for EU Qualified solution helps organizations obtain QES by verifying signer identities in line with eIDAS requirements.

2. Enabling AES and QES with DocuSign

DocuSign's identity verification options, such as ID document verification, knowledge-based authentication, and ID Verification for EU Qualified, allow organizations to achieve Advanced and Qualified Electronic Signatures.

By integrating these identity verification methods into the DocuSign eSignature workflow, organizations can ensure their agreements meet the necessary requirements for AES and QES under eIDAS. This helps enhance the security and legal enforceability of electronic agreements across the EU.

3. Meeting eIDAS Standards with DocuSign

The eIDAS regulation sets out specific standards for electronic signatures and trust services in the EU. DocuSign's identity verification and eSignature solutions are designed to comply with these standards.

DocuSign's platform is independently certified against EU technical standards for electronic signatures, ensuring that organizations can use DocuSign to meet eIDAS requirements. By leveraging DocuSign's eIDAS-compliant solutions, businesses can confidently enter into electronic agreements with customers and partners across the EU.

Want to save even more time in handling repetitive tasks? Automate sales with AI to get more done and focus on what really matters.

DocuSign's identity verification options enable organizations to achieve higher levels of e-signatures, including AES and QES, in compliance with eIDAS standards. You're now well-versed in how DocuSign helps verify signer identities for secure, legally-binding electronic agreements - just don't forget to actually use these features, or you might find yourself in a signature pickle!

Conclusions

Understanding DocuSign's identity verification process is crucial for ensuring secure, legally-binding electronic agreements.

In this comprehensive guide, we covered:

- DocuSign's robust identity verification methods, including ID document checks, phone authentication, and knowledge-based authentication

- When to use identity verification for high-value agreements, industry-specific requirements, and regulatory compliance

- The benefits of DocuSign's identity verification, such as fraud prevention, Google Docs integration, and enhanced security

- How DocuSign's identity verification enables higher levels of e-signatures (AES and QES) under eIDAS regulations

By mastering DocuSign's identity verification capabilities, you'll be well-equipped to create secure, compliant e-signatures - just don't forget to put your newfound expertise into practice, or you might find yourself in a digital identity crisis!

.svg)

.svg)

.svg)